MAaTTERS: A Tool to Manage Portfolios

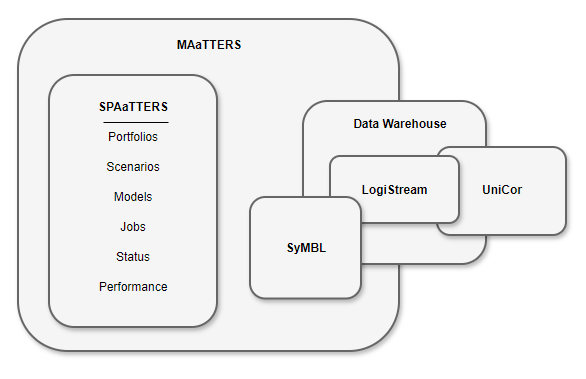

For years I've had this vision of trading and tracking those trades through various analyses. I'm fortunate to have sought out and had experiences which have augmented my view on how a system should be designed. Multi-Asset and Trade Total Evaluation Risk System (MAaTTERS) is a system to manage and review portfolios risks and Specialized Performance of Asset and Trade Total Evaluation Risk System (SPAaTTERS) is the associated front-end application built in Next.js which allows for the manual management of portfolio positions and their components. The application allows for not only the manual management of portfolios, but as well allows for managing specific market scenarios, custom pricing models, and manual jobs to schedule model testing through scenarios. Lastly, portfolio performance may also be tracked and monitored on the performance dashboard.

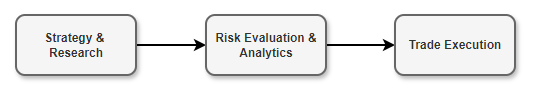

The typical user workflow of MAaTTERS is as shown below. It not only enables Portfolio construction, but as well allows for strategy and research, as well as trade execution, and analytics along with portfolio construction. By structuring the application in such a manner, more functionalities can be squeezed into a quick and efficient platform. This platform also enables usage with short, medium, and long-term strategies. With construction and evaluation being possible at any point in time within the life of the portfolio.

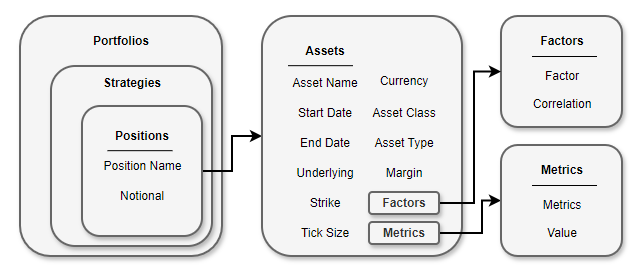

While the system is under ongoing development, final iterations will arrange the portfolio into a simple structure to track and evaluate individual components. This system allows for the individual pricing and evaluation of individual assets which can then be rolled-up to track performance as a whole. These individual evaluations can include factor, principal component, exposure or risk analysis to include a few. For immediate iterations of this structure, inclusion of the values associated with these evaluations will be excluded for a simpler version.

Now while this methodology does create portfolios it does not track the portfolio positions over time. I figure the best option is to store the full list of portfolios and their structures in an object to be reviewed at any point in time. To me, it does not seem too intensive to store this information even every minute or second if need be. Depending on the portfolio or length of strategies, periodic snapshots of the structure can be taken at whatever desired interval. Not only does this provide the benefit of tracking positions and holdings over time, but as well it can enable the system to rollback holdings to a discrete point in time.

MAaTTERS is also the parent to a larger ecosystem which runs multiple applications to fulfil the lifecycle of the trading process. MAaTTERS works with SyMBL to decides how to balance portfolios to manage risk as well as automate trading based on user designed strategies. UniCor is a tool to rapidly iterate data crawling and retrieval from any data source for any data structure into a raw data format, and LogiStream is the parent ETL tool which accomplishes various tasks such as time series transformation, data cleansing from UniCor, and realtime-strategy evaluation and for LogiStream.